How does Fetch Patch Insurance compare to the competition?

This is a Bias-Free Zone. Fluffillow is not affiliated with Fetch Pet Insurance.

If you’re scouting for Fetch Pet Insurance, you’re likely asking: Does it offer the coverage my pet’s needs? How will it affect my wallet? Is it a better choice than other insurers? This article dives into these pivotal questions, offering a comprehensive look at Fetch’s policies, pricing, and perks, alongside genuine customer experiences. Look no further for the knowledge you need to decide with confidence.

Table of Contents

- Key Takeaways

- Exploring Fetch Pet Insurance: An Overview

- Customizing Your Fetch Insurance Plan

- Add-on Wellness Coverage

- Understanding Fetch’s Claims Process

- Conclusion

- Frequently Asked Questions

Key Takeaways

- Fetch Pet Insurance offers a range of pet insurance options, including accident and illness coverage that’s tailored to your budget. They cover a spectrum of needs, from routine illnesses to unforeseen accidents. Fetch also includes treatments for breed-specific issues (e.g. elbow and hip dysplasia).

- In addition to standard coverage, Fetch provides insurance for chronic conditions, behavioral therapy, dental (every tooth), and alternative care with coverage options for holistic treatments.

- The claims process with Fetch is user-friendly and transparent, with a mobile app for filing and tracking claims, and direct deposit for reimbursements, along with active monitoring of claim status and deductible progress.

- Costs for Fetch Pet Insurance vary based on several factors, but monthly premiums can be tailored to budget and needs, with reimbursement up to 90% for covered expenses.

Exploring Fetch Pet Insurance: An Overview

Fetch Pet Insurance, formerly known as Petplan, offers comprehensive accident and illness coverage for dogs and cats. This insurance covers a range of veterinary needs including emergency and specialist visits, surgeries, cancer treatment, and various forms of therapy such as acupuncture and chiropractic care. Fetch also provides coverage for diagnostic tests, breed-specific conditions, and holistic treatments.

Unlike Spot Pet Insurance, however, Fetch doesn’t offer accident-only plans. Fetch also don’t cover pre-existing conditions or cosmetic procedures, although other pet insurers don’t either.

What’s Covered

- Emergency vet visits

- Online, in-home & office visits

- Hospital stays

- Physical therapy

- Allergies

- Surgeries

- X-rays & CT scans

- Name-brand prescription medications & supplements

- Canine infectious respiratory disease

- Ultrasounds

- Blood tests

- Breed-specific issues including hip dysplasia

- Specialists

- Sick-visit exam fees

- Laboratory tests

- Vomiting & diarrhea

- Hereditary & congenital issues

- Swallowed objects & toxins

- Dental (every tooth, plus gums)

- Gum disease

- Diabetes & insulin

- Cancer treatment

- Acupuncture & chiropractic care

- Treatment for aggression & separation anxiety

- Routine & preventive coverage (when you add Fetch Wellness)

What’s Not Covered

❌ Fetch Pet Insurance does not cover pre-existing conditions. A pre-existing condition is defined as any accident or illness that occurred, or for which your pet showed clinical signs, before enrollment, during the initial waiting period of up to 15 days, or before the pet’s first exam. Fetch provides extensive coverage in the U.S. and Canada for new accidents and illnesses, but excludes pre-existing conditions like most other insurance providers.

❌ Claims filed more than 90 days after treatment are not eligible for coverage. Fetch Pet Insurance requires that claims be submitted within 90 days from the date on the pet’s invoice to qualify for reimbursement. Claims submitted after this period will not be covered.

❌ Prescription food is also not covered by Fetch Pet Insurance. While Fetch covers supplements recommended by a veterinarian as treatment for a covered condition, it does not cover prescription food.

❌ Additionally, grooming and cosmetic procedures are not included in Fetch Pet Insurance’s coverage. Procedures such as tail docking, ear trimming, and declawing are considered cosmetic and are therefore not covered.

What Sets Fetch Insurance Apart from the Others

Fetch Pet Insurance distinguishes itself from other pet insurance providers in several key ways:

- Comprehensive Coverage Options: Fetch offers coverage for both accidents and illnesses, including breed-specific conditions, hereditary and congenital issues, and chronic diseases. Notably, they cover every tooth and not just canines, which is not always the case with other insurers.

- Holistic and Alternative Therapies: Unlike many insurers, Fetch covers alternative treatments administered by a vet, such as acupuncture, chiropractic care, homeopathic, and aromatherapy treatments, providing a broader range of care options for pet owners.

- Behavioral Therapy Coverage: Fetch includes coverage for behavioral therapy, which can be essential for pets with issues like separation anxiety or aggression. This therapy must be recommended by a veterinarian and can be an important aspect of a pet’s overall health.

- Flexibility in Veterinary Care: Fetch allows pet owners to use any licensed vet in the U.S. or Canada. This includes specialists and emergency clinics, giving owners flexibility to choose the best possible care without worrying about network restrictions.

- Quick Claims Processing: Fetch is noted for its fast reimbursement process, often completing claims within a few days. This rapid turnaround can significantly ease the financial stress of veterinary bills.

- Wellness Add-Ons: While Fetch does not cover routine care under standard plans, it offers wellness plans as an add-on, which can cover costs such as vaccinations, dental cleaning, and annual exams. This adds a layer of preventive care that can be tailored to a pet’s needs.

- Boarding and Advertising Costs: If a pet owner is hospitalized for four or more days, Fetch covers boarding fees for the pet. They also cover costs for advertising and rewards if a pet goes missing, which are features not commonly included in standard policies.

Customizing Your Fetch Insurance Plan

You can customize your Fetch Pet Insurance policy in several ways to better suit your needs and budget:

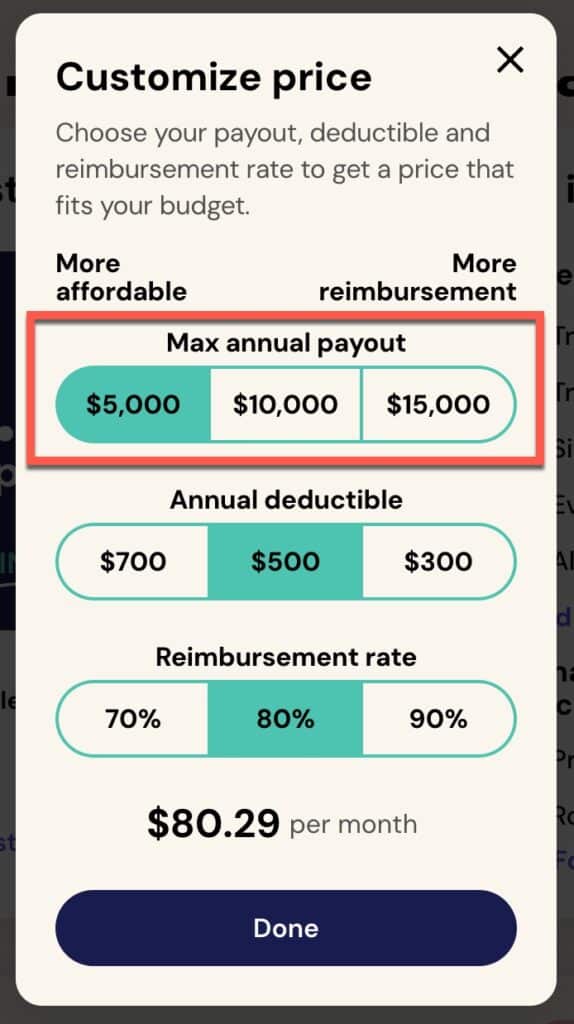

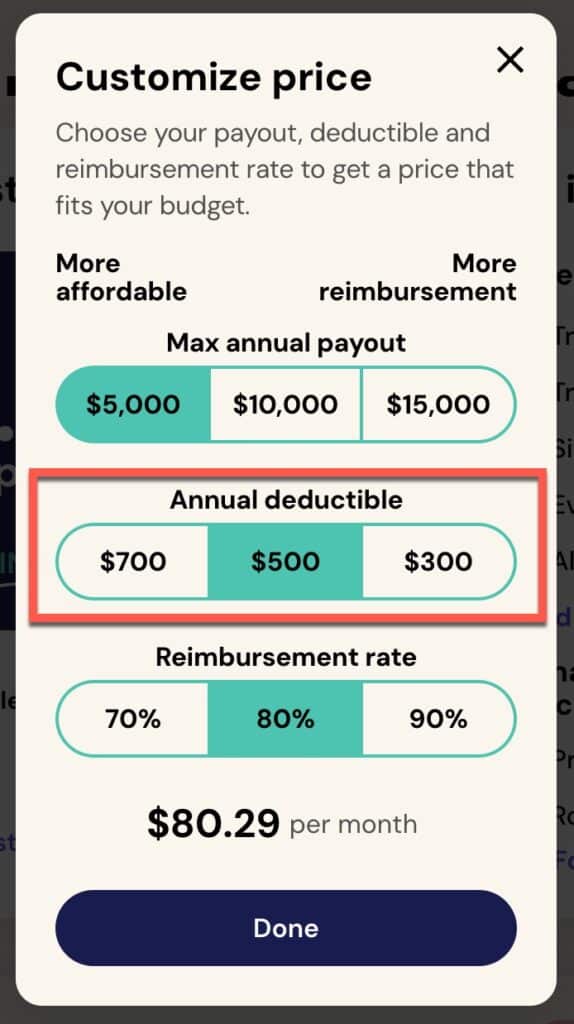

- Choice of Annual Limit: Fetch allows policyholders to choose their annual coverage limit, with options $5,000, $10,000 and $15,000.

- Deductible Options: You can select the Fetch deductible amount that works best for you between $300 and $700. Your chosen deductible affects your monthly premium costs and how much you pay out-of-pocket before insurance kicks in.

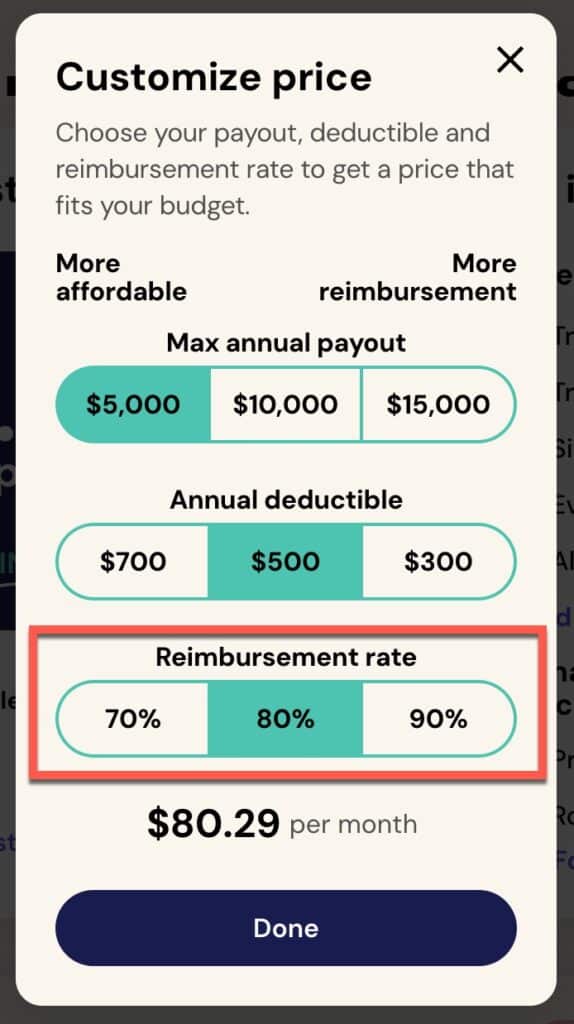

- Reimbursement Rates: Fetch offers different reimbursement levels, ranging from 70% to 90%. Choosing a higher reimbursement level will increase the monthly premium, but decrease the amount you’ll need to pay after meeting your deductible.

- Add-On Wellness Coverage: While standard Fetch policies focus on accidents and illnesses, you can add wellness coverage to cover preventive care such as vaccinations, annual exams, dental cleanings, and more. These wellness plans vary in the extent of what’s covered and can be tailored to include more comprehensive routine care.

- Optional Coverages: Some optional coverages may include things like coverage for lost pet advertising and reward, boarding fees if you are hospitalized, and even travel cancellation fees due to pet illness. These options can provide added protection beyond just medical care.

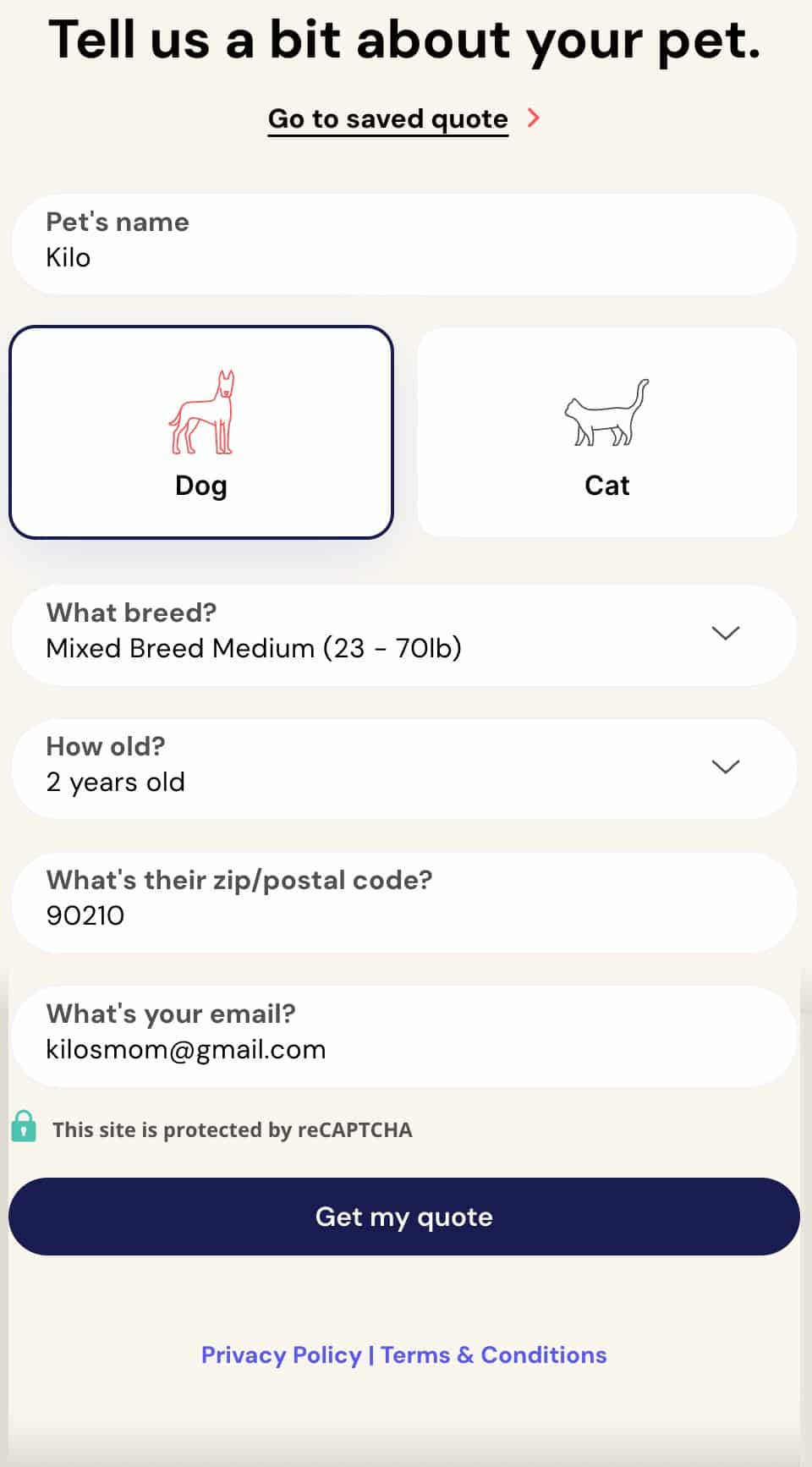

Fetch Insurance Quote is Based on Your Pet’s Information and Your Location

Before you see the cost of your insurance coverage, you’ll need to enter your pet’s information and location. Fetch bases its rates off these details.

Once you click “Get quote,” Fetch will analyze the information you provided and generate a premium quote.

This premium is what you pay to Fetch monthly for your coverage. You can customize the price by changing the annual limit, deductible, and reimbursement rate.

Annual Limits (aka Max Annual Payout)

Fetch allows policyholders to choose their annual coverage limit, with options $5,000, $10,000 and $15,000. The lower the max annual payout, the more affordable your monthly premium. The higher the max annual payout, the more reimbursement you’ll get in a coverage year. This may be worth it if you have a dog who you expect will need a lot of care.

For example, if your annual coverage limit is $5,000, Fetch will pay no more than $5,000 for pet health care services in a coverage year. Think of it as a bank account that only has $5,000 and once the bank account is empty, you have to wait for the following year to use it again.

Deductibles

You can select the Fetch deductible amount that works best for you between $300 and $700. Deductibles in pet insurance are the amounts that pet owners must pay out-of-pocket before the insurance coverage begins to reimburse vet bills.

For example, if your deductible is $300, and your vet bill is $500, then you will pay the vet $300 from your own pocket before Fetch kicks in any money.

Keep in mind that your monthly payment to Fetch will be more with a $300 deductible than a $700 deductible. A higher deductible usually means a lower monthly premium (i.e. the amount you pay for your insurance every month).

Reimbursement Rates

Fetch Pet Insurance offers different reimbursement levels, ranging from 70% to 90%. Choosing a higher reimbursement level will increase the monthly premium, but decrease the amount you’ll need to pay (typically called a “co-pay”) after meeting your deductible.

For example, let's say your vet bill is $1000, your deductible is $500, and your reimbursement rate is 80%. Spot will pay $400 and you will owe the vet $500 to cover the deductible, plus an additional $100 from your own pocket. Here's the math: $1000 minus $500 out of pocket (deductible) = $500. $500 x 80% = $400 paid by Fetch. $500 minus $400 = $100. Your total out of pocket = $100 + $500 = $600.

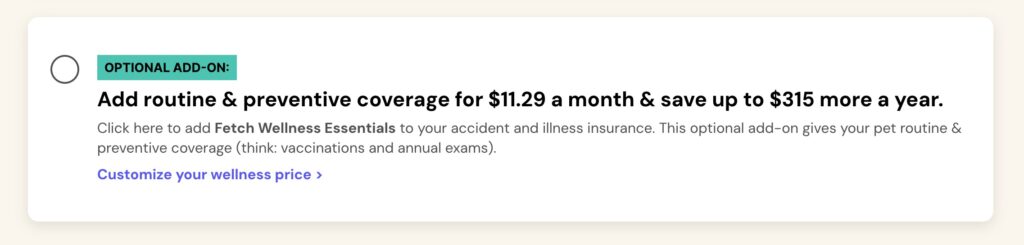

Add-on Wellness Coverage

Fetch’s add-on “routine and preventative coverage” includes vaccinations and annual exams. Wellness coverage doesn’t replace the comprehensive accident and illness coverage, but is intended to complement it by covering preventive care not included in the main policy.

The good news is that these add-ons have no waiting period, deductible or co-pay.

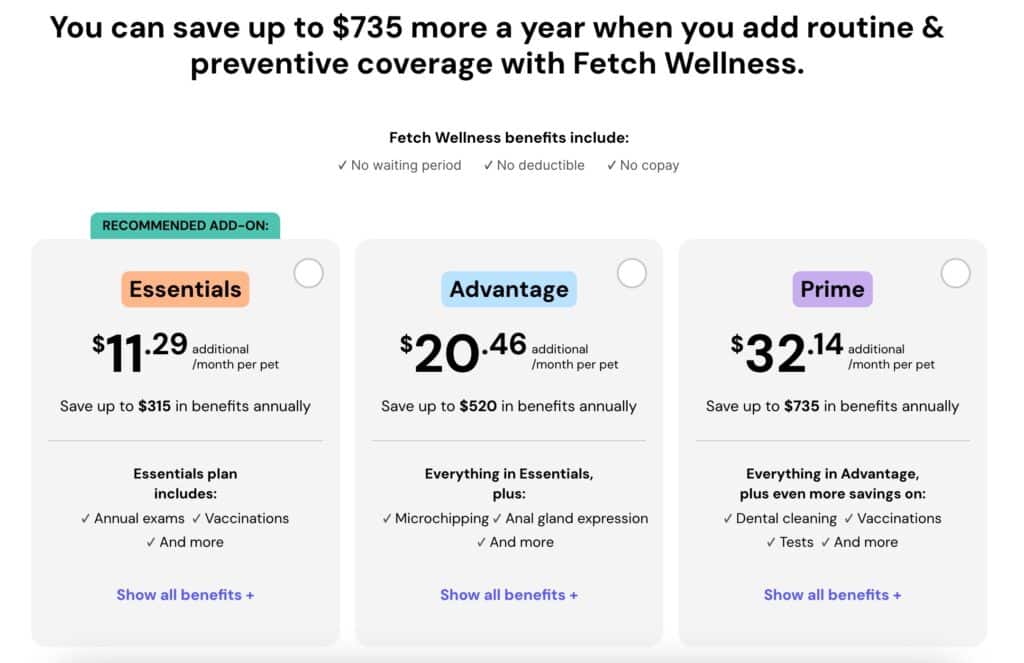

Essentials Plan

The Essentials Preventive Care plan is designed to help cover routine care expenses and maintain the overall health of your pet. Here’s a breakdown of what the Essentials plan typically includes:

- Annual exam

- Canine Bordetella / Feline FELV vaccines

- Canine DHLPP / Feline FVRCP vaccines

- Canine Rabies / Feline Rabies vaccines

- Canine Lyme / Feline FIP vaccines

- Heartworm, flea & tick prevention

- Heartworm tests

- Dental cleaning

- Spaying or neutering

- Blood test

- Urinalysis

- Fecal test

Advantage Plan

For broader preventive care, Fetch provides the Advantage plan, which includes:

- Everything included in the Essentials Plan

- Microchipping

- Anal gland expression

Prime Plan

For the most extensive preventative care, Fetch provides the Prime plan, which includes:

- Everything included in the Essentials and Advantage Plans

- Behavioral exam

- Health certificate

- Activity monitor

Understanding Fetch’s Claims Process

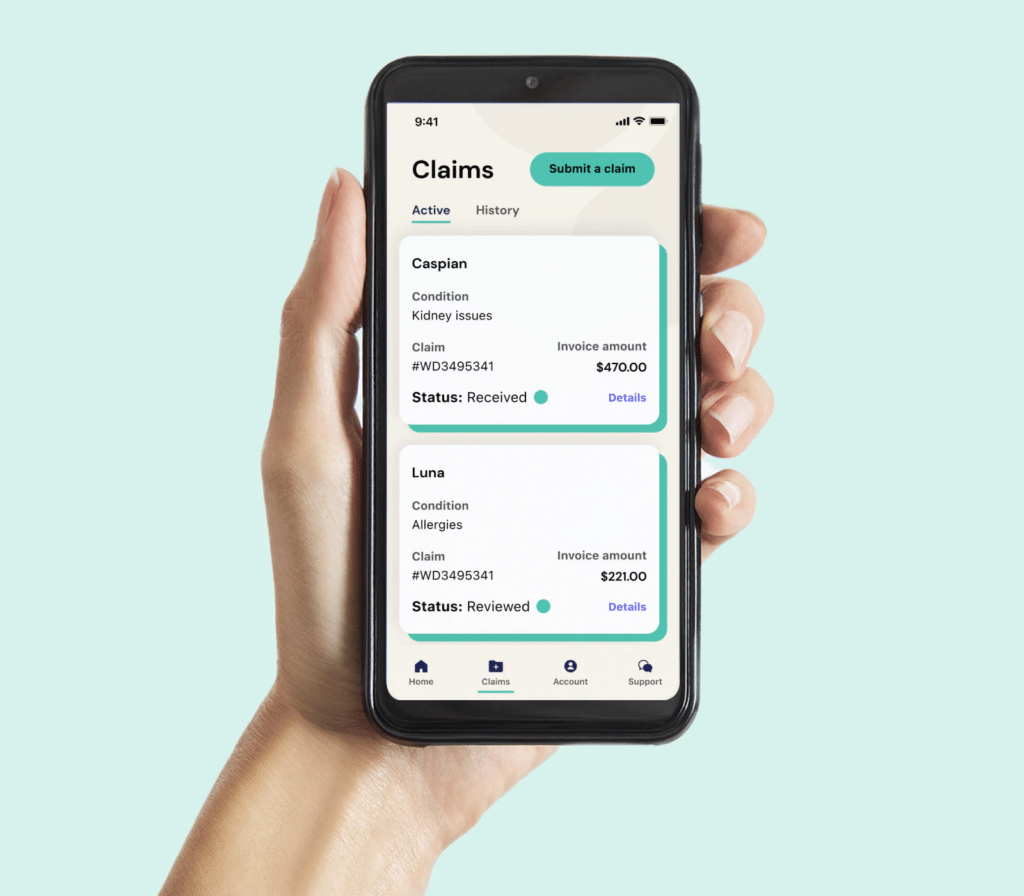

One of the significant aspects of any insurance is the claims process. Fetch Pet Insurance shines in this area with a user-friendly app that simplifies the claim filing process. The app enables the scanning of documents, allowing users to take pictures of invoices and medical records to upload them conveniently as one file. This makes the claims submission process a breeze for pet owners.

But, the app’s features don’t end there. It allows you to actively keep track of your invoice submissions, medical records, and payment statuses for both current and closed claims. Fetch also provides clear explanations of claim payouts with an Explanation of Benefits that details how reimbursements are calculated. This ensures transparency in the claim process, leaving no room for confusion or surprises.

Filing Claims Made Simple

Fetch makes it possible to file claims faster with its user-friendly online interface. The claims submission process is made more convenient for pet owners, as all necessary documents and information can be easily uploaded, making the process free of unnecessary paperwork and excessive wait times.

Moreover, Fetch offers direct deposit for insurance claim payments, speeding up the reimbursement process. Owners can also track their deductible progress throughout the claims process, giving them a clear overview of their remaining deductible amount. This feature not only enhances the speed of the process but also improves the transparency of the claims resolution.

Visibility into Your Claim Status

With the Fetch Pet Insurance app, you’re never left in the dark about your claim status. The app includes features that allow pet owners to:

- Actively monitor the status of their current and past claims

- Ensure full transparency

- Be aware of your claim’s progress, from the moment you file it until resolution

In addition to monitoring claim status, users can also track their deductible progress to see how much of it has been met through their claims. This gives a clear overview of the remaining deductible amount. And if you have any questions regarding the status of your claims, you can access an interactive chat feature in the app, available 24/7 for round-the-clock assistance.

To top it all off, Fetch automatically texts updates to users regarding the processing status of their claims. It’s all about keeping you informed and in control.

Conclusion

In conclusion, Fetch Pet Insurance stands out with its comprehensive coverage, user-friendly claims process, and flexible pricing options. It offers peace of mind to pet owners, knowing they can provide the best care for their pets without breaking the bank. While no pet insurance is perfect, Fetch’s commitment to transparency, customer service, and the overall health and well-being of pets make it a worthy contender in the world of pet insurance.

Frequently Asked Questions

Does Fetch Pet Insurance cover pre-existing conditions?

No, Fetch Pet Insurance does not cover pre-existing conditions, which is a common policy among pet insurance companies. Any conditions your pet has before the start of coverage will not be covered.

Does Fetch offer any wellness plans?

Yes, Fetch does offer a wellness plan as an add-on to their standard accident and illness coverage, which includes preventive services like vaccinations and dental cleanings.

Can I adjust my premium with Fetch?

Yes, you can adjust your premium with Fetch by choosing different annual limits, co-pay percentages, and deductible options.

How long does it take for Fetch to process claims?

Customers generally find that Fetch processes claims in a reasonable timeframe, and you can track the status of your claim through the Fetch app.

Can I enroll my older pet in Fetch Pet Insurance?

Yes, you can enroll your older pet in Fetch Pet Insurance, as there is no upper age limit for enrolling pets with Fetch.

How do I cancel Fetch Pet Insurance?

To cancel your Fetch Pet Insurance policy, you have several options:

- Phone Cancellation: You can call Fetch customer service at 1-866-467-3875 during their operating hours, Monday through Friday from 9am to 6pm EST, to cancel your policy directly over the phone. This method allows you to speak to a representative, ask any questions, and ensure that you understand the refund process.

- Email Cancellation: If you prefer to cancel in writing, you can email Fetch at info@fetchpet.com. This provides a record of your request and can be useful for confirming the cancellation.

- Mail Cancellation: Alternatively, you can send a written notice of cancellation to Fetch Pet Insurance, PO Box 1489, Bolingbrook, IL 60440.

When you cancel within the first 30 days of your policy, provided that no claims have been submitted, Fetch will refund the entire premium. If you cancel after the first 30 days, the refund will be prorated based on the date of termination. Always request a confirmation of termination in writing, either by email or mail, to avoid any issues with accidental billing after cancellation.